Professional complianceProfessional operation team, years of experience in

blockchain and financial industry, holding a compliant

digital asset trading license, and a 100% deposit

guarantee.

Professional complianceProfessional operation team, years of experience in

blockchain and financial industry, holding a compliant

digital asset trading license, and a 100% deposit

guarantee.

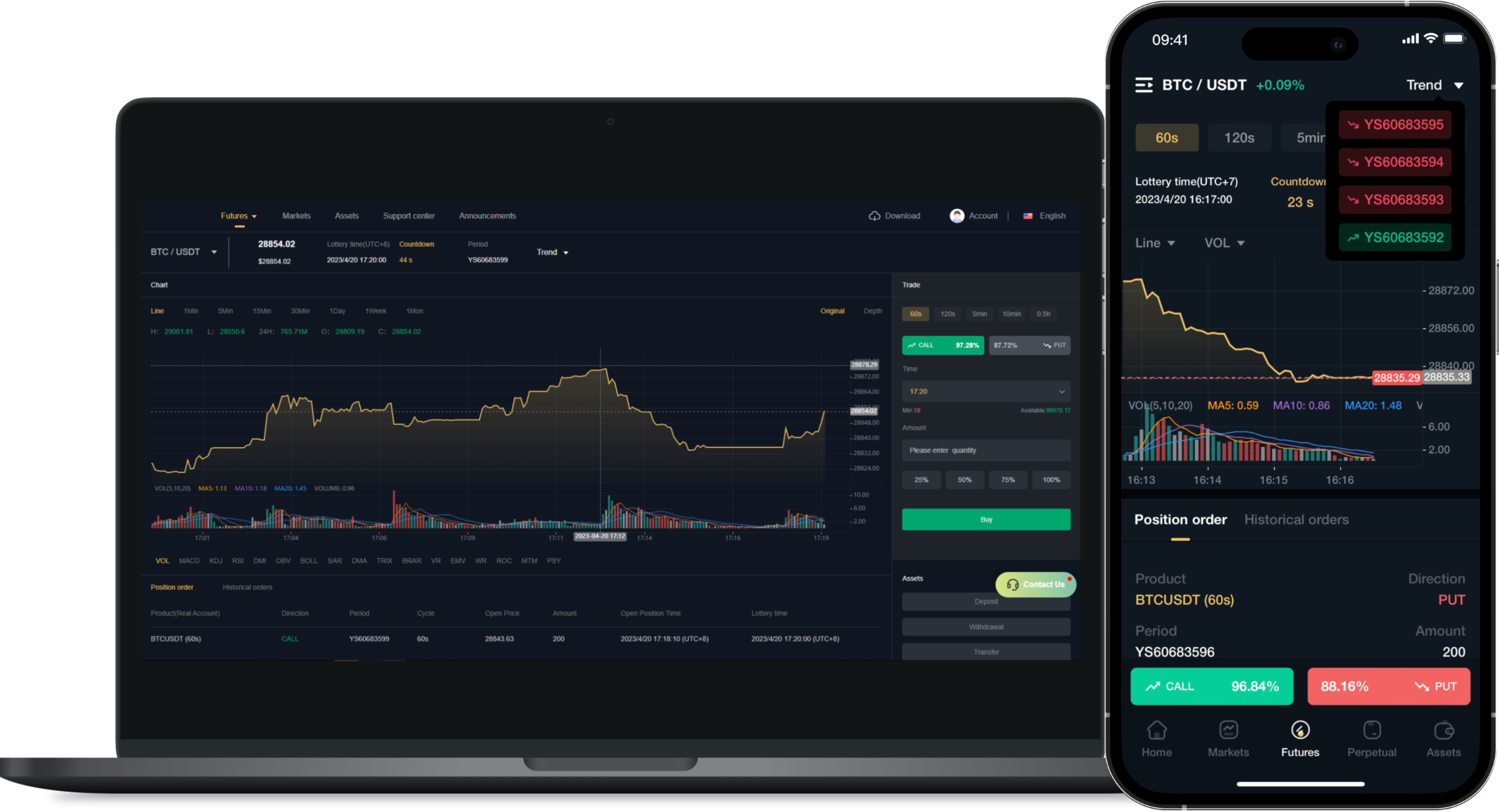

High performanceWith 300,000 transactions per second, the order response

time is less than 1 millisecond.

High performanceWith 300,000 transactions per second, the order response

time is less than 1 millisecond.

CBEX Exchange Global Professional Station is an innovative digital asset trading platform that serves professional trading users around the world and is committed to discovering high-quality and innovative digital asset investment opportunities. Currently, it provides more than 40 digital asset product trading and investment services. Headquartered in the Singapore, it is operated by the CBEX exchange global professional station team. CBEX exchange is the world's leading blockchain asset financial service provider. It has provided high-quality services to millions of users in more than 130 countries around the world. It has independent offices, trading operations and operation centers in United States, South Korea, Hong Kong, and medium-sized countries and regions. CBEX exchange and its sub-brands are in a leading position in the world in terms of technology platform, product line, security risk control system, operation and customer service system.

Buy and sell digital currency with zero handling feeUse a variety of payment methods to trade digital currency,

0 fee, safe and fast

Buy and sell digital currency with zero handling feeUse a variety of payment methods to trade digital currency,

0 fee, safe and fast

Optimal transaction fee ratePreferential transaction rates, competitive VIP rights,

enjoy the best quality service

Optimal transaction fee ratePreferential transaction rates, competitive VIP rights,

enjoy the best quality service

24*7 hours customer service support24*7 hours all-weather, full-time operation mode, we will

answer your inquiries as soon as possible.

24*7 hours customer service support24*7 hours all-weather, full-time operation mode, we will

answer your inquiries as soon as possible.